Group Accident Insurance

Group Accident Insurance Policy

The School has taken up a Group Personal Accident policy for your child/ward with Income Insurance Ltd.

Parents/guardians should note that medical treatment at private hospitals typically costs higher, and parents/guardians may need to pay more out-of-pocket expenses if treatment costs exceed the policy’s coverage limits.

Ineligible expenses or expenses in excess of the limits will be borne by the student/parents/ guardians.

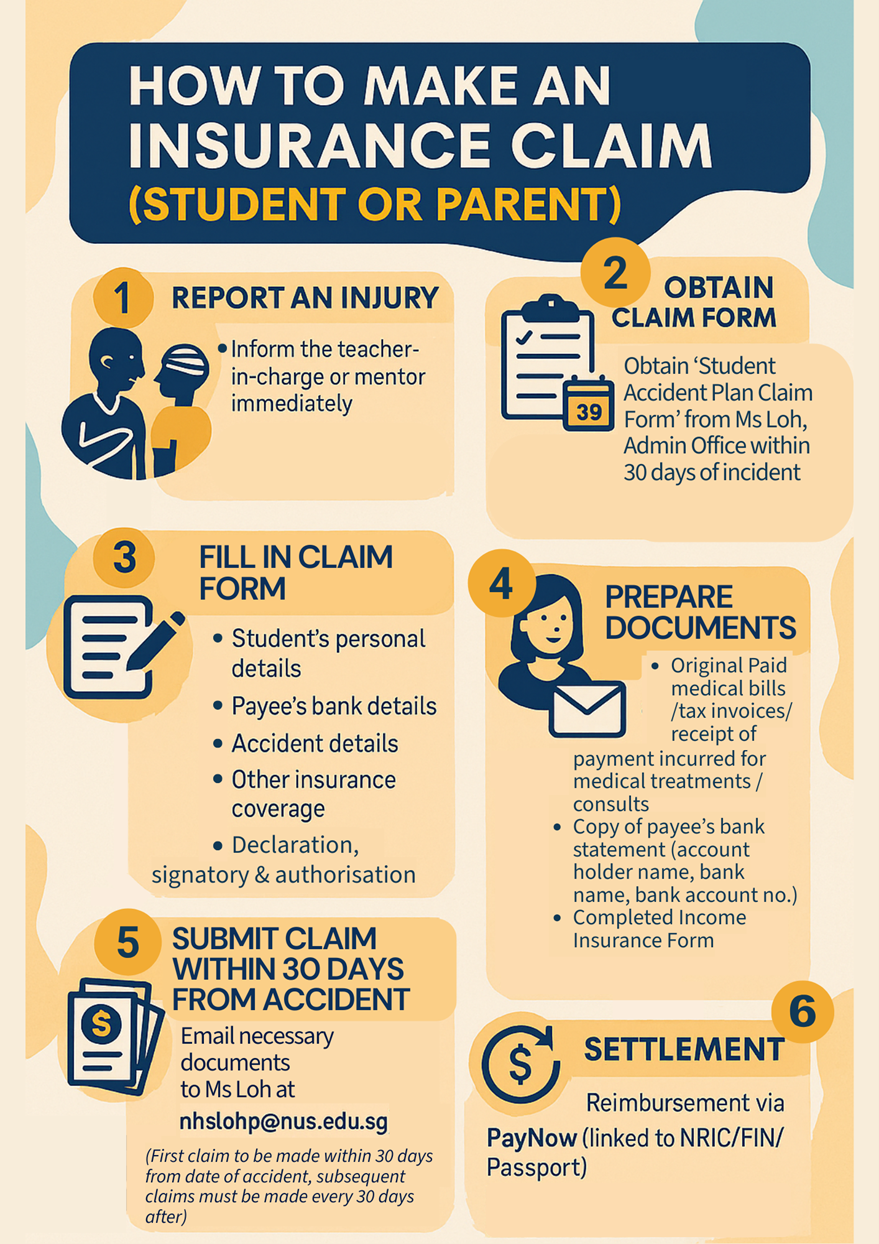

Please refer to the details below for submitting a claim or contact the Admin Office for further enquiries.

Basic of Cover as per schedule:

|

Benefits |

Sum Insured/Limit Per Student (Up to) |

|

1) Accidental Death |

S$50,000 |

|

2) Accidental Permanent Disablement (including Third Degree Burns) |

Up to 150% of Accidental Death Benefit |

|

3) Funeral Benefit/Burial Expenses |

S$5,000 |

|

4) Medical Expenses for injury due to an accident (sum of outpatient and inpatient medical expenses) |

Up to S$13,000 with the following sub-limit: |

|

|

a. Outpatient expenses (up to S$2,150 including S$400 sublimit for

Chinese Medicine Practitioner)

|

|

|

Physiotherapy at specialist outpatient clinics (SOC) in restructured hospitals and Singapore Sports Council. |

|

|

|

|

|

b) Inpatient expenses (up to S$10,850) for inpatient and follow-up treatments after hospitalisation due to an accident including daily room and board (including ICU), capped at S$120 per day, in-hospital consultation and surgery expenses, for other hospital services (eg. X-rays, MRI, prescription, medical supplies, operating theatre). |

|

|

|

|

|

c) Reconstructive surgical expenses arising from an accident (up to S$13,000) including medical consultation, test, surgical procedure and medical treatment before/after the surgery. |

|

|

|

|

|

d) Dental treatments recommended or asked by a medical practitioner for the Insured Person to be treated (up to S$4,000) |

|

|

For accident overseas, the insured must seek treatment within 7 days of returning to Singapore. |

|

|

Note:

|

|

5) Hospitalisation Allowance (overseas and upon return) |

S$50 per day, max S$50 days |

|

6) Temporary/Permanent Mobility Aid, Prosthesis and Other Implants |

Up to S$5,000

|

|

|

|

|

Extensions/Clauses |

|

|

- 2nd Degree Burn |

up to S$5,000 |

|

- Additional Accidental Death Benefit due to Natural Catastrophe (Additional Payout) |

S$5,000 |

|

- Ambulance Costs |

up to S$500 |

|

- Automatic Increase in Benefit (Additional Payout) |

5% of sum insured or S$12,500 whichever lower |

|

- Assault, Hijack & Murder |

Covered |

|

- Comatose State Benefit |

Up to 10% of Accidental Death Sum or S$50,000 whichever is lower |

|

- Domestic and Nursing Assistance Benefit |

S$1,000 |

|

- Drowning and Suffocation by Gas, Poisonous Fumes or Smoke |

Covered |

|

- Emergency Evacuation and Repatriation |

Not Covered |

|

- Emergency Travel Expenses / Visitor Benefit |

Not Covered |

|

- Extends to cover injury, illness, disease or Death resulting from complications or related to attacks by venomous or disease transmitting insects, reptiles, amphibians, sea creatures and animals |

Covered |

|

- Exposure & Disappearance (12 months) |

Covered |

|

- Food Poisoning in School or during a School Activity |

Covered |

|

- Full Terrorism Cover |

Covered (including Nuclear Chemical and Biological Terrorism) |

|

- HIV Due to blood Transfusion |

up to S$5,000 |

|

- Motor Cycling |

Covered |

|

- Non-Elective Surgery |

up to S$5,000 |

|

- Public Conveyance (Additional Payout) |

Covered |

|

- Physiotherapy |

Refer to Medical Expenses |

|

- Repatriation of Mortal Remains |

Not Covered |

|

- Scarring of Face |

S$500 |

|

- Second Degree Burns |

S$5,000 |

|

- Strike Riot & Civil Commotion |

Covered |

|

- Terrorism Benefit (Additional Payout) |

Not Covered |

|

- Trauma Counselling, Psychiatric and Psychological Treatment |

S$1,000 |

|

- 'Infectious disease' under the Infectious Disease Act (Cap.137) due to and arising from exposure in the insured's school premises or during any school-related activity, whether in Singapore or elsewhere. |

|

|

|

|

|

Territorial / Geographical Limit (s) |

(a) To cover students while within their premises (including boarding school 24 hours cover) regardless of whether they are participating/attending any school activities. |

|

|

|

|

(b) To cover students participating in the school's activities, including home-based learning & blended learning, and/or activities approved / organized / endorsed / sponsored / authorized by NUS High School. |

|

|

|

|

|

(c) To cover students traveling directly between residence and school or venue outside their premises for school activities, and/or activities approved / organized / endorsed / sponsored / authorized by NUS High School. |

|

|

|

|

|

(d) To cover students overseas travel on worldwide 24 hours basis for purpose of participating/attending to activities outside Singapore that are approved / organized / endorsed / sponsored / authorized by NUS High School. |

|

|

|

|

|

(e) To cover students on community involvement program approved / endorsed by NUS High School. |

|

|

|

|

|

(f) To cover students on job attachment assigned and approved by NUS High School. |

|

|

|

|

|

Major Exclusions |

- Self-inflicted injuries or any attempt thereat, while sane or insane. |

|

- Insurrection, declared or undeclared war or any warlike operations, military or naval service in time of declared or undeclared war or while under orders for warlike operations or restoration of public order. |

|

|

- Participating in riot, committing an assault or felony. |

|

|

- Participation in competitive racing on wheels. |

|

|

- Contracts (Rights of Third Parties) Act (Cap. 53B) |

Important Note: Above summary provides a brief outline of the coverage and for the full details, please refer to the policy's terms and conditions.